Medicare Resources

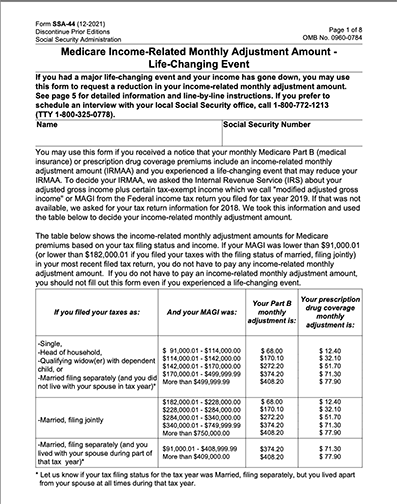

Part B IRMAA / Part D IRMAA

To Read the Full Article

| Full Part B Coverage | |||

| Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-Related Monthly Adjustment Amount |

Total Monthly Premium Amount |

| Less than or equal to $103,000 | Less than or equal to $206,000 | $0.00 | $174.70 |

| Greater than $103,000 and less than or equal to $129,000 | Greater than $206,000 and less than or equal to $258,000 | $69.90 | $244.60 |

| Greater than $129,000 and less than or equal to $161,000 | Greater than $258,000 and less than or equal to $322,000 | $174.70 | $349.40 |

| Greater than $161,000 and less than or equal to $193,000 | Greater than $322,000 and less than or equal to $386,000 | $279.50 | $445.20 |

| Greater than $193,000 and less than $500,000 | Greater than $386,000 and less than $750,000 | $384.30 | $559.000 |

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | $419.30 | $594.00 |

Premiums for high-income beneficiaries with full Part B coverage who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

| Full Part B Coverage | ||

| Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses, with modified adjusted gross income: | Income-Related Monthly Adjustment Amount | Total Monthly Premium Amount |

| Less than or equal to $103,000 | $0.00 | $174.70 |

| Greater than $103,000 and less than $397,000 | $384.30 | $559.00 |

| Greater than or equal to $397,000 | $419.30 | $594.00 |

Medicare Part D (Drugs) Income-Related Adjustment Amount (IRMAA)

To Read the Full Article

| Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-related monthly adjustment amount |

| Less than or equal to $103,000 | Less than or equal to $206,000 | $0.00 |

| Greater than $103,000 and less than or equal to $129,000 | Greater than $206000 and less than or equal to $258,000 | $12.90 |

| Greater than $129,000 and less than or equal to $161,000 | Greater than $258,000 and less than or equal to $322,000 | $33.30 |

| Greater than $161,000 and less than or equal to $193,000 | Greater than $322,000 and less than or equal to $386,000 | $53.80 |

| Greater than $193,000 and less than $500,000 | Greater than $386,000 and less than $750,000 | $74.20 |

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | $81.00 |

Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

| Beneficiaries who are married and lived with their spouses at any time during the year, but file separate tax returns from their spouses, with modified adjusted gross income: | Income-related monthly adjustment amount |

| Less than or equal to $103,000 | $0.00 |

| Greater than $103,000 and less than $397,000 | $74.20 |

| Greater than or equal to $397,000 | $81.00 |

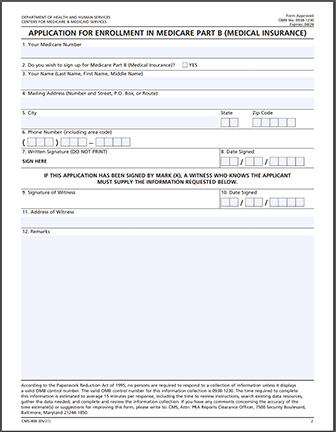

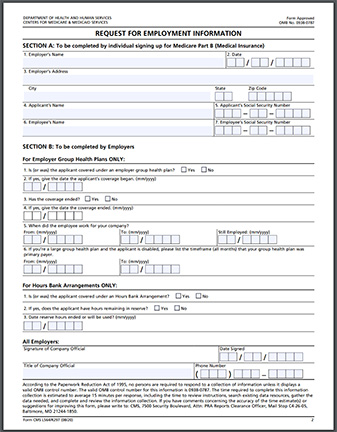

Special Events (Loss of Employer Coverage)

- You will need these two forms to be filled out if you already have Part A.

- Click the links below and download the forms.

CMS 40B

Contact Us

Our no pressure process give you the information you need to make informed, intelligent decisions.

By providing your name and contact information, you consent to receive calls, text messages, and/or emails from a licensed insurance agent about Medicare Plans at the number provided, even if you are on a government do-not-call registry. This agreement is not a condition of enrollment.

Not connected with or endorsed by the United States government or the federal Medicare program. This is a solicitation of insurance, and your response may generate communication from a licensed producer/agent.