Retirement Income Planning

What if you had a table with only two legs;

how stable do you think that table will be?

Watch This Video First!

Your IRA could be in trouble in ways you may not have even considered yet. Millions of retirees are walking straight into a financial trap, and it’s called Required Minimum Distributions (RMDs). Where’s the trap?

Imagine the market crashing… and you’re forced to withdraw from your retirement accounts anyway. That’s the harsh reality of RMDs, and it’s stressing people out about running out of money or draining assets they could have used for their legacy. .

Most people turn to two common strategies:

1️⃣ Ride the market while it’s hot

2️⃣ Shift into “safer” assets like IRA bonds or money market accounts

But here’s the truth: Those strategies have massive flaws once RMDs kick in.

Big Beautiful Bill

Trump’s “Big Beautiful Bill” is now law. At 870 pages, it’s a lot to digest. Many of you have asked us how this bill may affect you

In this video, Ann and I break it all down into two areas that matter most for your retirement:

- Income deductions

- 5 strategies to protect your retirement

We go beyond the basics that you might have already heard. How you can take advantage of the new changes and include advanced ROTH conversion strategies, ways to lower future RMDs, and how to protect your income for the long haul, so you don’t outlive your savings.

Reduce RMD Taxes

Once you hit a certain age, the IRS makes you start pulling money from your IRA or 401(k), whether you need it or not!

Without proper planning, these Required Minimum Distributions (RMDs) can push you into higher tax brackets, shrink your legacy, and trigger every retiree’s biggest fear: running out of money.

In this video, we walk through 8 simple strategies to help reduce the impact of RMDs and keep more of your money working for you.

They’re Hiding This Strategy

One strategy that’s gaining quiet traction is the Hybrid Pension — an under-the-radar solution that can provide contractual payouts of 10% to 20% annually, depending on how it’s structured.

Naturally, many people ask us:

“If these payouts are real, why haven’t I heard more about them?”

That’s exactly why we created this short, easy-to-follow video to explain the facts behind Hybrid Pensions—and how high-net-worth individuals have been using them for years to simplify retirement income planning.

Are You Ready for Recession?

While it’s disheartening to witness so many losing their investments, it reinforces the value for those who have supported their retirement with a Hybrid Pension. Your contract guarantees that even in the worst market conditions, your income remains secure.

Choosing the optimal retirement strategy has always mattered, but right now, timing your movements is equally critical.

Know The Fine Print on Annuities

Are you worried about depleting your assets? Does the thought of not having enough money in retirement leave you feeling stuck? I hope you’re ready to learn our strongest strategy for planning your retirement!

Join Ann and me in our newest video as we dive into the powerful strategy STAGING & LADDERING to get you annuity payouts of 10% to 20%!

Our Must See : 4-Step Playlist!

Watch These Videos on Our Youtube Channel

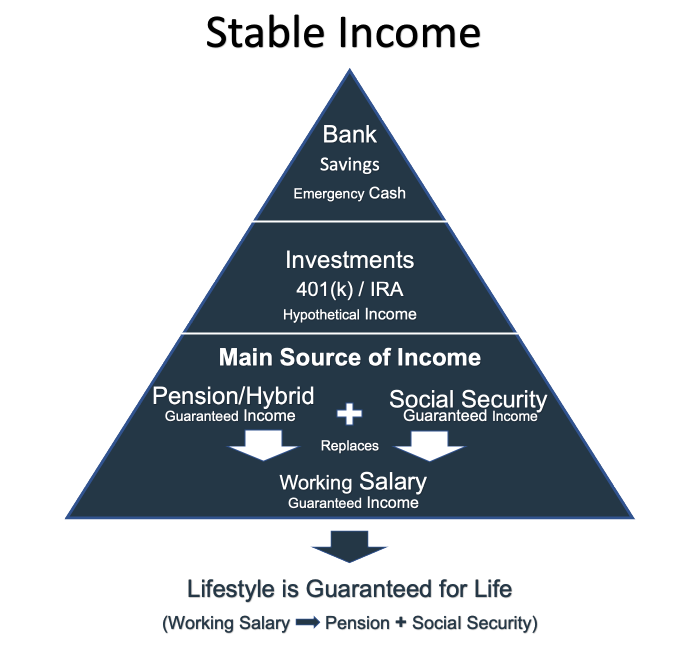

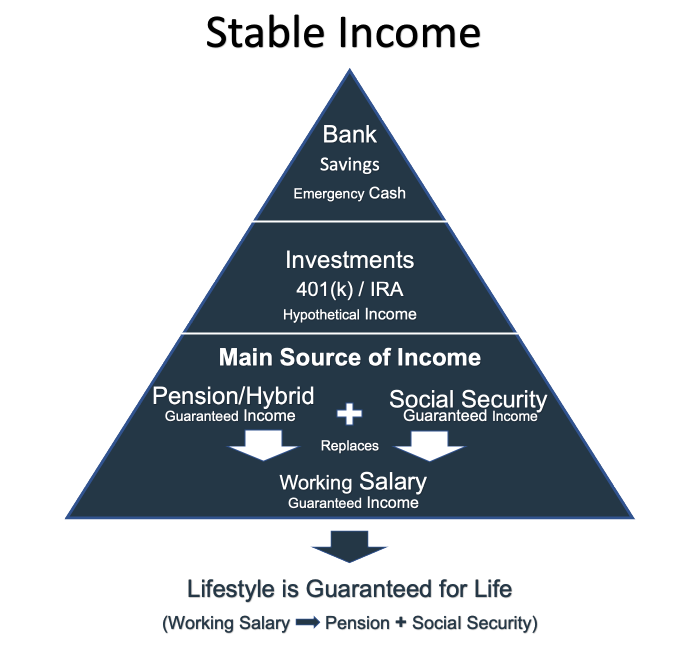

Retirees today face a much more significant challenge than past generations. Before, many retirees did not have to worry about outliving their assets and could enjoy their retirement years. There was a lot less stress, not because of inflation, but because past generations had three sources of income, 2 of which were guaranteed income for life:

- Traditional Pension (this replaced most, if not all, your working salary)

- Social Security (this was to supplement your pension)

- Investments, IRAs & Savings (this was extra income you did not depend on)

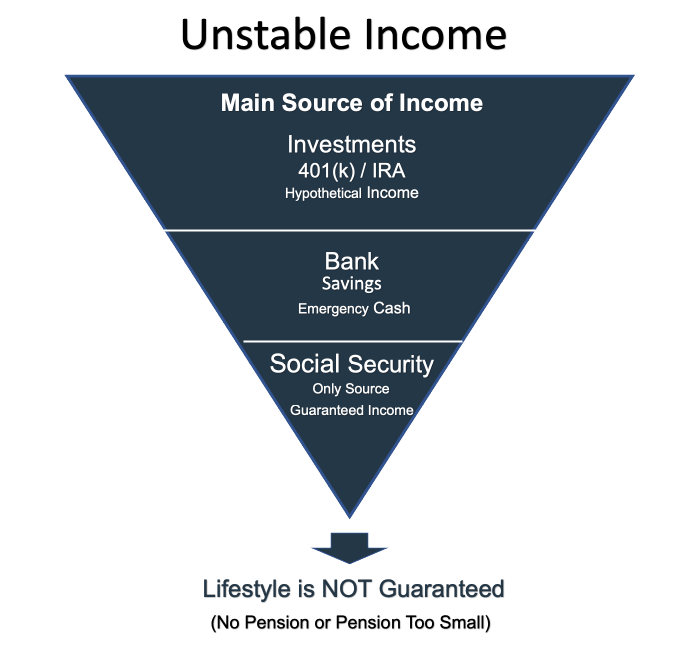

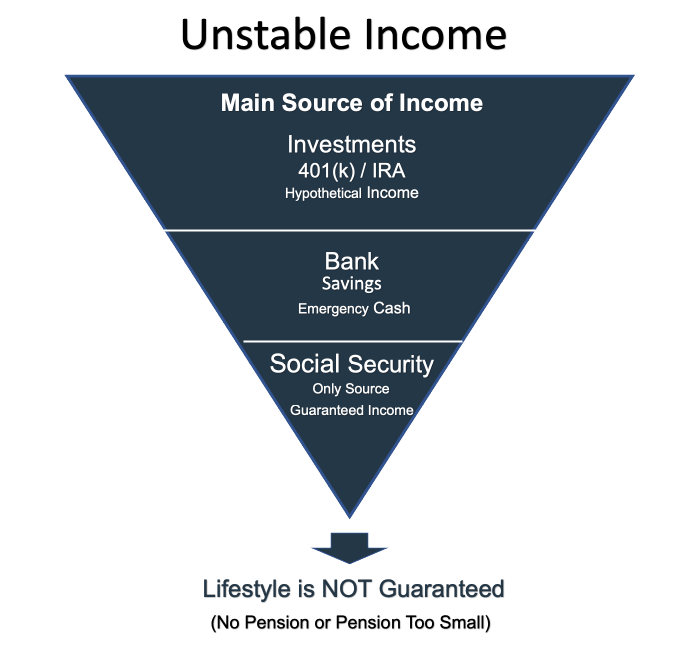

Most of us do not have a job that provides a pension. Therefore, we save and save and save, hoping that our 401(k), 403(b), 457, IRA, or brokerage investment accounts will duplicate what pensions did.

Do you have a traditional pension plan? Are you worried it’s not enough?

Are you only living on Social Security as your only guaranteed source of income? Or do you only have a 401(k)/IRA and are concerned about outliving your money? Do you have a written strategy that guarantees you against the market’s volatility? Would you like to learn how to recession-proof your life or lifestyle? Would you like to learn how to create a Pension Hybrid of your own?

While investments have a place in our retirement plan, why should our lifestyle and expenses depend on an income that is not guaranteed? Would we be committed to a career where our primary income source turned on stocks and bonds? Of course not. Even if we are self-employed, at least we control our destiny. Our income is not controlled by external market conditions or tenants paying their rent. This guaranteed income through our salary guarantees the lifestyle that we want. Guarantee that it is in writing. To learn more about Pension and Pension Hybrids, watch the videos above.

We all know that investment income can be high. At the same time, we have all either seen or been through some tough years, for example, the 2008 Great Recession. When you work, the market’s volatility is not a big deal. Just ride it out, and it will eventually bounce back. Our focus is coaching you on how to recession-proof your lifestyle, guarantee your income when you retire, yes, when you lose your other source of guaranteed income, your salary. Our goal is to reach this simple formula:

Working Salary = Guaranteed Income = Guaranteed Lifestyle

Pension or Pension Hybrid = Guaranteed income = Guaranteed Lifestyle

Investment Income = Uncertain Income =Uncertain Lifestyle

Some may ask, “What’s wrong with having investments as an income source?” There is nothing wrong with real estate or investments as sources of income. We firmly believe investments, including real estate, should be part of our retirement portfolio.

“What’s wrong with having investments as income sources, especially if I’m well-diversified?”

What we teach, however, is not just being diversified, but rather well allocated.

What’s the difference between diversification and allocation? According to www.merriam-webster.com, to allocate means to “apportion for a specific purpose.”

To diversify means “to increase in the variety….”

Yes, to diversify and to allocate can have similar meanings. To allocate means, there is a clear “specific purpose.” However, that lack of clear understanding has caused many people to lose one clear fact.

Allocation = “apportion for a specific purpose.”

Diversification = “an increase in the variety.”

To illustrate, think about our kitchen utensils. We might have a very nice diversified set of knives. What if this well-diversified knife set was all we had in our kitchen? Would we be so proud because we kept saving so many knives for years? Would we tell our friends they can use our diversified knife sets to eat their salad? Sure, it could be used, but that would be very dangerous! Please, never do this! Would we say that having only a well-diversified knife set is the same as saying we have a well-allocated set of utensils? Wouldn’t it make more sense that we say that we have a well-diversified set of spoons, a nice diversified set of forks, and a cool diversified set of knives? Why do we have different sets of utensils? Yes, we allocated the spoons, the forks, and the knives for their own specific purpose. The allocation versus diversification formula is simple. Diversification = Variety. Allocation = Purpose.

Diversification = Increase in Variety

Allocation = Specific Purpose.

Diversification Example

5 Spoons of different sizes

3 Forks of different sizes

20 Piece Knife Set

Allocation Example

Spoons = Soup

Forks = Salad

Knives = Steak

What is the purpose of our income when we retire? Is it only for vacations that we have once in a while? Is it just for emergencies? If so, investments or money saved in the bank can be used for that.

For most of us, though, we have guaranteed expenses to cover, and in some cases, our expenses might increase due to ongoing healthcare costs like Medicare and long-term care expenses. We might only have Social Security as our only source of income. Most importantly, we would not want the lifestyle we created through our salary also to be guaranteed.

So, while using a knife to eat a salad could be accomplished, we too could use our investments for income. However, why do we want to use hypothetical income, our diversified investment portfolio, (income that is at risk through market volatility or we live too long), to fund our lifestyle? Would that be the best way to allocate our money for ongoing expenses that are guaranteed to be also there for life?

Next, think about what utensil do you use most each day. Let’s use a fork, for example. A fork is something that would be hard to live without. Likewise, the lack of guaranteed income can make life very stressful.

Remember this one fact that cannot be argued. No asset itself, no bank account, and no real estate can put in writing “guaranteed income for life. None period”

“No asset itself …can put guaranteed income for life in writing. None, period.”

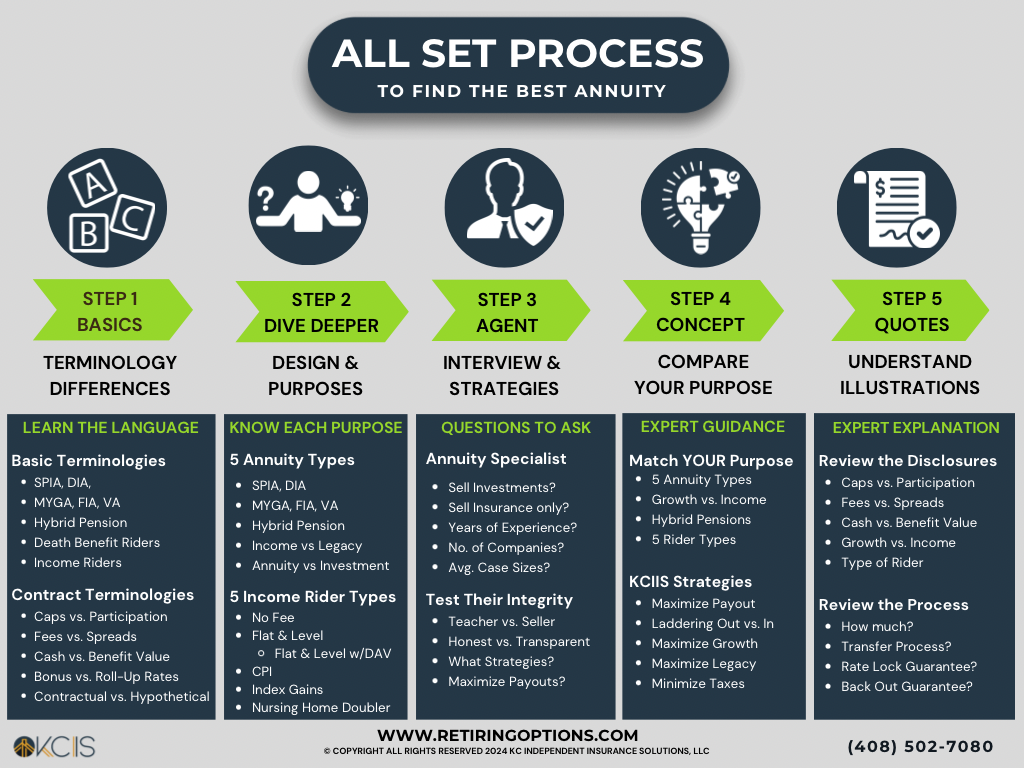

So, what is a pension or pension hybrid, then? To learn the details, click here.

Simply put, a pension or pension hybrid is a promise in writing called insurance. You are ensuring that you will never outlive your money. You are insuring against market risks and recessions. Social Security is also an insurance policy. You pay taxes called FICA, which stands for Federal Insurance Contribution Act.

A traditional pension is also called an annuitization or living benefit. Yes, every teacher’s pension, government worker’s pension, and police officer’s pension is an annuity. This type of annuity, however, does not have cash value. You cannot change your mind and cash out. So, be careful before choosing this type of annuity. There are five different types of annuities you should learn about before deciding on a policy.

Below is the fundamental difference between a retirement account like a 401(k) or IRA vs. a Pension or Pension Hybrid.

Investments =

Asset Control (Cash Value)

No Guaranteed Income

Pensions =

Insurance Protection (Guaranteed Income for life)

No Cash Value

Pension Hybrids =

Insurance Protection

Guaranteed Income for life + Asset Control (Cash Value)

So, Which triangle below describes your retirement?

Have you ever heard of a Pension Hybrid? Have you learned about the 3 Bucket Income Planning Strategy so you will have income for life that is guaranteed? Would you like to learn how to create tax-free income? (hyperlink with tax-free income to the life planning page)

“Goodbye Tension & Hello Pension!”

Let me help you find the right solutions where you can have “peace of mind” and where your principal is always guaranteed from market loss. My diversified portfolio of solutions will help you generate a stable, guaranteed lifetime income that you will never outlive and pass on a legacy to your loved ones.

Of course, part of having a stable retirement is taking care of the “uncertainties” of life. The two primary uncertainties or gaps we all face in planning for retirement are healthcare costs and loss of income. Healthcare costs include Medicare, Medicare Supplements Plans (Medigaps), Medicare Advantage Plans, Medicare Part D Plans, Dental, and Vision Plans. The average price is currently around $2000 to $4000 per year per person. Plus, retirees have to face rate increases each year.

Call us for our free coaching sessions, where we can write a strategy that guarantees you income for the rest of your life & guarantees your principal from any potential market loss or recession. Income for life that is guaranteed can help you also shop around for the best Medicare plan to fit your needs.

Yes, say, “Goodbye to tension, and hello to your pension (hybrid)!”

2024 Medicare Part D: Know THESE 3 Things Before Enrolling!

When Playing this Video - Click the red play button in the bottom right corner to subscribe to my videos!

5 HUGE CHANGES You Need To Know | 2024 Medicare Part D

Subscribe to our channel to get the most up-to-date videos regarding Medicare.

Click here to watch more videos on our Youtube Channel

By providing your name and contact information you are consenting to receive calls, text messages, and/or emails from a licensed insurance agent about Medicare Plans at the number provided. You agree that such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not-call registry. This agreement is not a condition of enrollment.

Not connected with or endorsed by the United States government or the federal Medicare program. This is a solicitation of insurance, and your response may generate communication from a licensed producer/agent.

Contact Us

Our no pressure process give you the information you need to make informed, intelligent decisions.

By providing your name and contact information, you consent to receive calls, text messages, and/or emails from a licensed insurance agent about Medicare Plans at the number provided, even if you are on a government do-not-call registry. This agreement is not a condition of enrollment.

Not connected with or endorsed by the United States government or the federal Medicare program. This is a solicitation of insurance, and your response may generate communication from a licensed producer/agent.