Common Misconceptions About Long-Term Care Insurance

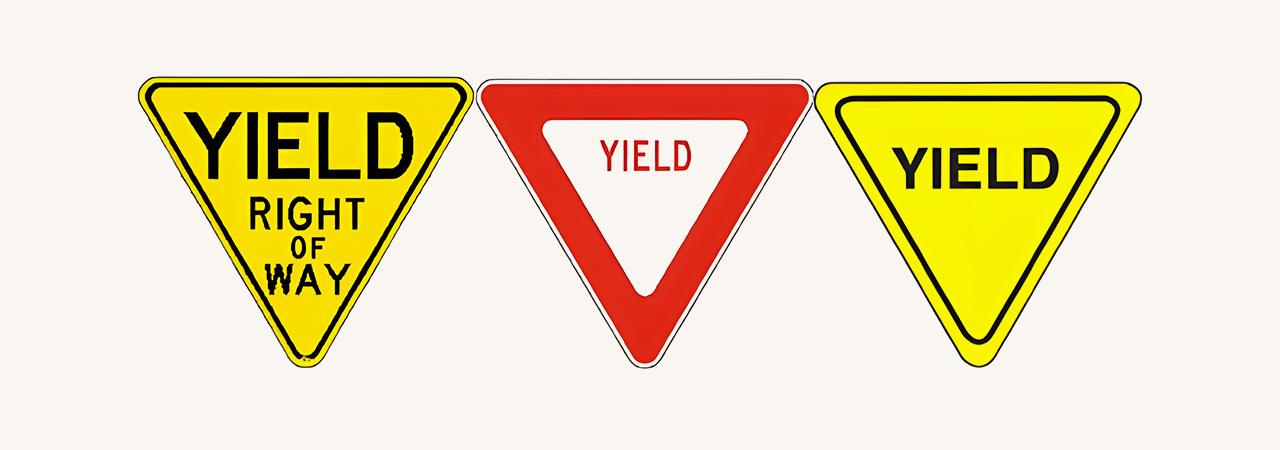

If I asked you what color a yield sign is, what would you say? Yellow? Orange? Neither. The correct answer is Red and White. Just like the yield sign, most of us have the wrong perception of what Long-Term Care Insurance (LTC) really is.

Many people say they would rather “pull the plug” than think about long-term care. The truth is that this is actually “end-of-life-care”, and those services fall under Skilled Nursing or Hospice. But what about the type of care family members used to provide at home? That is also long-term care, and Long-Term Care Insurance can cover it.

What Does Long-Term Care Insurance Cover?

In the past, family members often acted as caregivers. Today, families are smaller, and both sons and daughters typically work, leaving fewer options for care at home. Without coverage, many seniors will be forced to “spend down” assets or deplete savings.

“Spending down” for long-term care (LTC) refers to the process of using up one’s own assets and income to pay for nursing home, assisted living, or in-home care until they reach a level low enough to qualify for Medicaid assistance.

Long-Term Care insurance can help cover:

- Home health aides and caregivers

- Assisted living facilities

- Skilled nursing facilities

- Hospice and respite care

How Much Do Long-Term Care Services Cost?

The cost of long-term care continues to rise faster than most investments.

- Ten years ago:

- Nursing homes averaged $50,000–$60,000 per year.

- Assisted living averaged $24,000–$36,000 per year.

- Today:

- Home health aides in the Bay Area average $25 per hour.

- Assisted living averages $48,000–$60,000 per year.

- Nursing home care ranges from $90,000–$120,000 per year.

Without a plan, how far would your retirement savings and legacy stretch before running out?

Why Self-Insuring May Not Be the Best Plan

You likely have health insurance, homeowner’s insurance, and car insurance. So why not Long-Term Care insurance?

Some people assume Medicare or their health insurance will cover these costs. The reality: Medicare does not cover ongoing long-term care.

Statistics show that 70% of Americans will need long-term care at some point in their lives. By comparison, far fewer will ever file a claim on homeowners or auto insurance.

Long-Term Care Insurance Provides Tax-Free Benefits

Some retirees consider self-insuring because they have enough assets. But why self-insure when you could receive benefits completely tax-free?

Self-insuring often requires selling assets or stocks, which can push you into a higher tax bracket. With Long Term Care Insurance, if you were receiving $100,000 per year in benefits, that entire amount could be tax-free, protecting both your lifestyle and your family’s legacy.

Protect Your Retirement With

a Long-Term Care Plan

Contact UsGet in Touch

Have a question or feedback?

Fill out the form below, and we’ll respond promptly!

By providing your name and contact information, you are consenting to receive calls, text messages, and/or emails from a licensed insurance agent about Medicare Plans at the number provided. You agree that such calls and/or text messages may use an auto-dialer or robocall, even if you are on a government do-not-call registry. This agreement is not a condition of enrollment.

Not connected with or endorsed by the United States government or the federal Medicare program. This is a solicitation of insurance, and your response may generate communication from a licensed producer/agent.